# IMPORT DATA FILES USED BY THIS NOTEBOOK

import os, requests

file_links = [("data/Prices_DAM_ALTA2G_7_B1.csv", "https://ndcbe.github.io/CBE60499/data/Prices_DAM_ALTA2G_7_B1.csv")]

# This cell has been added by nbpages. Run this cell to download data files required for this notebook.

for filepath, fileurl in file_links:

stem, filename = os.path.split(filepath)

if stem:

if not os.path.exists(stem):

os.mkdir(stem)

if not os.path.isfile(filepath):

with open(filepath, 'wb') as f:

response = requests.get(fileurl)

f.write(response.content)

# This code cell installs packages on Colab

import sys

if "google.colab" in sys.modules:

!wget "https://raw.githubusercontent.com/ndcbe/CBE60499/main/notebooks/helper.py"

import helper

helper.install_idaes()

helper.install_ipopt()

helper.install_glpk()

helper.download_data(['Prices_DAM_ALTA2G_7_B1.csv'])

helper.download_figures(['battery.png','pyomo-table-4.1.png',

'pyomo-table-4.2.png','pyomo-table-4.3.png',

'pyomo-table-4.4.png','pyomo-table-4.6.png'])

import pandas as pd

import pyomo.environ as pyo

import numpy as np

import matplotlib.pyplot as plt

In many regions of the world, including the US, electricity generation is scheduled through wholesale electricity markets. Individual generators (resources) transmit information about their operating costs and constraints to the market via a bid. The market operator then solves an optimization problem (e.g., the unit commitment problem) to minimize the total electricity generator cost. The market operator decides which generators to dispatch during each hour to satisfy the forecasted demand while honoring limitations for each generator (e.g., maximum ramp rate, the required time for start-up/shutdown, etc.).

Read more information here:

The CSV (comma separated value) file Prices_DAM_ALTA2G_7_B1.csv contains price data for a single location in California for an entire year. The prices are set every hour and have units $/MWh. We will use the package pandas to import and analyze the data.

# Load the data file

ca_data = pd.read_csv('./data/Prices_DAM_ALTA2G_7_B1.csv',names=['price'])

# Print the first 10 rows

ca_data.head()

| price | |

|---|---|

| 0 | 36.757 |

| 1 | 34.924 |

| 2 | 33.389 |

| 3 | 32.035 |

| 4 | 33.694 |

Next we can calculate summary statistics:

ca_data.describe()

| price | |

|---|---|

| count | 8760.000000 |

| mean | 32.516994 |

| std | 9.723477 |

| min | -2.128700 |

| 25% | 26.510000 |

| 50% | 30.797500 |

| 75% | 37.544750 |

| max | 116.340000 |

Next, let's visualize the data in a histogram:

plt.hist(ca_data["price"])

plt.xlabel('Day-Ahead Market Energy Price [$/MWh]',fontsize=18)

plt.ylabel('Count',fontsize=18)

plt.grid(True)

plt.show()

Finaly, let's visualize the prices during the first full calendar week. The data are for calendar year 2015. For reference, January 1, 2015 was a Thursday.

offset = 4 # days

number_of_days = 7

first_week = ca_data["price"].to_numpy()[(0 + offset)*24: (0 + offset + number_of_days)*24]

# Customize the major and minor ticks on the plots

from matplotlib.ticker import MultipleLocator

fig, ax = plt.subplots()

# Plot data

ax.plot(range(0,number_of_days*24), first_week)

# Set major ticks every 24 hours (1 day)

ax.xaxis.set_major_locator(MultipleLocator(24))

# Set minor ticks every 6 hours

ax.xaxis.set_minor_locator(MultipleLocator(6))

# Set labels, add grid

plt.xlabel('Hour',fontsize=18)

plt.ylabel('DAM Energy Price [$/MWh]',fontsize=18)

plt.grid(True)

plt.show()

Energy (price) arbitrage is the idea of using energy storage (e.g., a battery) to take advantage of the significant daily energy price swings. This gives rise to many analysis questions including:

If a battery energy storage system perfectly timed it's energy purchases and sales (i.e., it could perfectly forecast the market price), how much money could it make from energy arbitrage?

We can answer this question using mathematical/computational optimization!

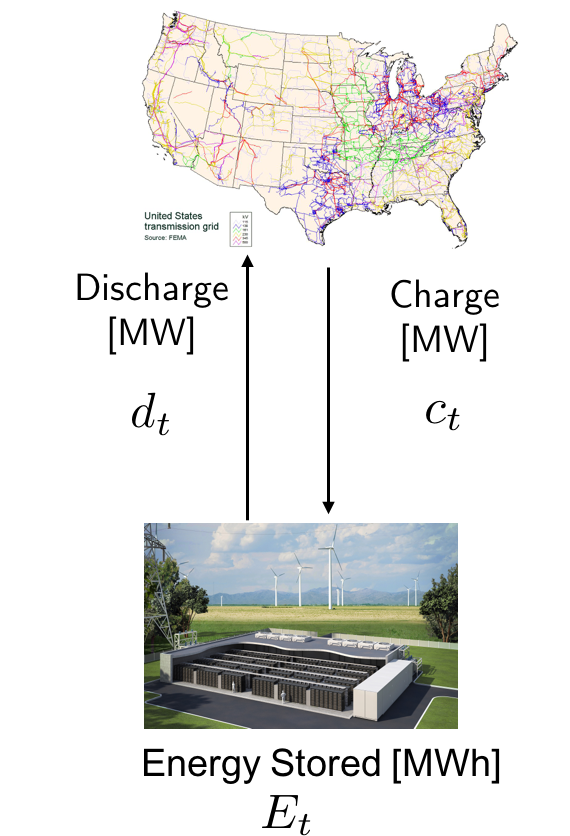

Let's start by drawing a picture.

Let's say we want to define our optimization problem over a 24 hour window. The day-ahead market sets the energy prices in 1-hour intervals. We'll define the set

$$\mathcal{T} = \{0, 1, ..., N\}$$for time where $N = 24$ for a 24-hour planning horizon. For convienence, we'll also define $\mathcal{T}' := \mathcal{T} / \{0\}$, which is the original set $\mathcal{T}$ substract subset $\{0\}$.

Next, let's identify the variables in the optimization problem:

Notice how all of these variables are indexed by the timestep $t$. We'll write in the model $t \in \mathcal{T}'$

Parameters are data that are constant during the optimization problem. Here we have:

Finally, we'll identify the objective, which is the function to improve, and the mathematical constraints. Below is the full mathematical model for the problem:

Before we program our model in Pyomo, it is very important to first perform a degree of freedom analysis. Here are the steps:

The degrees of freedom are the number of decisions variables that be freely manipulated by the optimizer. If there are no degrees of freedom, we ofter say the problem is square or it is a simulation problem.

For now, we will ignore inequality constraints and bounds. Later in the semester we will revisit degree of freedom analysis using some optimization theory concepts (e.g., active sets).

ConcreteModel¶We will start by creating a concrete Pyomo model. Recall, Pyomo is an object-oriented algebriac modeling language. The line below creates an instance of the ConcreteModel class.

m = pyo.ConcreteModel()

For those unfamilar with object-oriented programming, m is a container to define an optimization model. It includes a bunch of functionality to interface with different optimization solvers, perform diagnostics, and inspect the solution.

Pyomo also supports abstract models, but we will stick with concrete models this semester. See the Pyomo textbook for more details if you are curious.

We start by declaring a set for time. From above, recall we want to index all of the variables and constraints over the set

$$ \mathcal{T}' = \mathcal{T} / \{0\} = \{1, ..., N\} $$# Save the number of timesteps

m.N = 24

# Define the horizon set

m.HORIZON = pyo.Set(initialize=range(1,m.N+1))

Some Pyomo modelers prefer to use all capital names for sets; this is a personal preference.

Next, we can declare our three variables: $E_t$, $c_t$, $d_t$

# Charging rate [MW]

m.c = pyo.Var(m.HORIZON, initialize = 0.0, bounds=(0, 1), domain=pyo.NonNegativeReals)

# Discharging rate [MW]

m.d = pyo.Var(m.HORIZON, initialize = 0.0, bounds=(0, 1), domain=pyo.NonNegativeReals)

# Energy (state-of-charge) [MWh]

m.E = pyo.Var(m.HORIZON, initialize = 0.0, bounds=(0, 4), domain=pyo.NonNegativeReals)

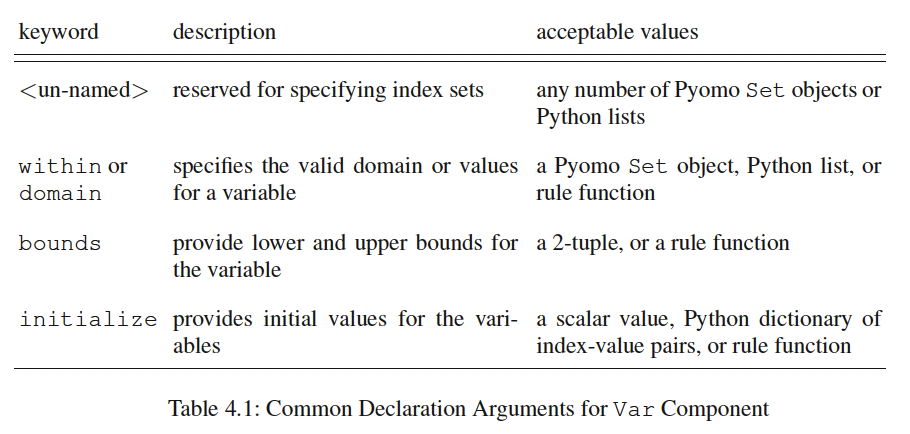

See the table below (Hart et al., 2017) for an explanation of the arguments for Var:

Pyomo also supports units. Even though we are not explicitly using the feature, the units for all variables are clearly marked in the comments.

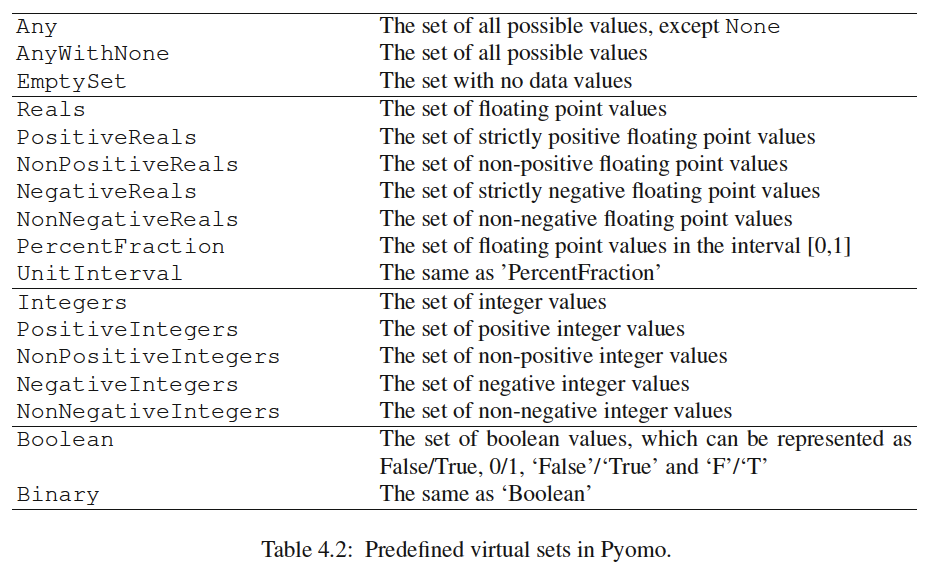

The following table (Hart et al., 2017) shows the options for the within/domain variable keyword:

In the example above, domain=pyo.NonNegativeReals is not needs, as we are specifying stricker bounds. It is included above to show the syntax.

The next step is to define the parameter data: $\pi_t$ (energy prices), $\eta$ (round trip efficiency) and $E_0$ (intial energy storage level).

# Square root of round trip efficiency

m.sqrteta = pyo.Param(initialize = pyo.sqrt(0.88))

# Energy in battery at t=0

m.E0 = pyo.Param(initialize = 2.0, mutable=True)

m.pprint()

1 Set Declarations

HORIZON : Size=1, Index=None, Ordered=Insertion

Key : Dimen : Domain : Size : Members

None : 1 : Any : 24 : {1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24}

2 Param Declarations

E0 : Size=1, Index=None, Domain=Any, Default=None, Mutable=True

Key : Value

None : 2.0

sqrteta : Size=1, Index=None, Domain=Any, Default=None, Mutable=False

Key : Value

None : 0.938083151964686

3 Var Declarations

E : Size=24, Index=HORIZON

Key : Lower : Value : Upper : Fixed : Stale : Domain

1 : 0 : 0.0 : 4 : False : False : NonNegativeReals

2 : 0 : 0.0 : 4 : False : False : NonNegativeReals

3 : 0 : 0.0 : 4 : False : False : NonNegativeReals

4 : 0 : 0.0 : 4 : False : False : NonNegativeReals

5 : 0 : 0.0 : 4 : False : False : NonNegativeReals

6 : 0 : 0.0 : 4 : False : False : NonNegativeReals

7 : 0 : 0.0 : 4 : False : False : NonNegativeReals

8 : 0 : 0.0 : 4 : False : False : NonNegativeReals

9 : 0 : 0.0 : 4 : False : False : NonNegativeReals

10 : 0 : 0.0 : 4 : False : False : NonNegativeReals

11 : 0 : 0.0 : 4 : False : False : NonNegativeReals

12 : 0 : 0.0 : 4 : False : False : NonNegativeReals

13 : 0 : 0.0 : 4 : False : False : NonNegativeReals

14 : 0 : 0.0 : 4 : False : False : NonNegativeReals

15 : 0 : 0.0 : 4 : False : False : NonNegativeReals

16 : 0 : 0.0 : 4 : False : False : NonNegativeReals

17 : 0 : 0.0 : 4 : False : False : NonNegativeReals

18 : 0 : 0.0 : 4 : False : False : NonNegativeReals

19 : 0 : 0.0 : 4 : False : False : NonNegativeReals

20 : 0 : 0.0 : 4 : False : False : NonNegativeReals

21 : 0 : 0.0 : 4 : False : False : NonNegativeReals

22 : 0 : 0.0 : 4 : False : False : NonNegativeReals

23 : 0 : 0.0 : 4 : False : False : NonNegativeReals

24 : 0 : 0.0 : 4 : False : False : NonNegativeReals

c : Size=24, Index=HORIZON

Key : Lower : Value : Upper : Fixed : Stale : Domain

1 : 0 : 0.0 : 1 : False : False : NonNegativeReals

2 : 0 : 0.0 : 1 : False : False : NonNegativeReals

3 : 0 : 0.0 : 1 : False : False : NonNegativeReals

4 : 0 : 0.0 : 1 : False : False : NonNegativeReals

5 : 0 : 0.0 : 1 : False : False : NonNegativeReals

6 : 0 : 0.0 : 1 : False : False : NonNegativeReals

7 : 0 : 0.0 : 1 : False : False : NonNegativeReals

8 : 0 : 0.0 : 1 : False : False : NonNegativeReals

9 : 0 : 0.0 : 1 : False : False : NonNegativeReals

10 : 0 : 0.0 : 1 : False : False : NonNegativeReals

11 : 0 : 0.0 : 1 : False : False : NonNegativeReals

12 : 0 : 0.0 : 1 : False : False : NonNegativeReals

13 : 0 : 0.0 : 1 : False : False : NonNegativeReals

14 : 0 : 0.0 : 1 : False : False : NonNegativeReals

15 : 0 : 0.0 : 1 : False : False : NonNegativeReals

16 : 0 : 0.0 : 1 : False : False : NonNegativeReals

17 : 0 : 0.0 : 1 : False : False : NonNegativeReals

18 : 0 : 0.0 : 1 : False : False : NonNegativeReals

19 : 0 : 0.0 : 1 : False : False : NonNegativeReals

20 : 0 : 0.0 : 1 : False : False : NonNegativeReals

21 : 0 : 0.0 : 1 : False : False : NonNegativeReals

22 : 0 : 0.0 : 1 : False : False : NonNegativeReals

23 : 0 : 0.0 : 1 : False : False : NonNegativeReals

24 : 0 : 0.0 : 1 : False : False : NonNegativeReals

d : Size=24, Index=HORIZON

Key : Lower : Value : Upper : Fixed : Stale : Domain

1 : 0 : 0.0 : 1 : False : False : NonNegativeReals

2 : 0 : 0.0 : 1 : False : False : NonNegativeReals

3 : 0 : 0.0 : 1 : False : False : NonNegativeReals

4 : 0 : 0.0 : 1 : False : False : NonNegativeReals

5 : 0 : 0.0 : 1 : False : False : NonNegativeReals

6 : 0 : 0.0 : 1 : False : False : NonNegativeReals

7 : 0 : 0.0 : 1 : False : False : NonNegativeReals

8 : 0 : 0.0 : 1 : False : False : NonNegativeReals

9 : 0 : 0.0 : 1 : False : False : NonNegativeReals

10 : 0 : 0.0 : 1 : False : False : NonNegativeReals

11 : 0 : 0.0 : 1 : False : False : NonNegativeReals

12 : 0 : 0.0 : 1 : False : False : NonNegativeReals

13 : 0 : 0.0 : 1 : False : False : NonNegativeReals

14 : 0 : 0.0 : 1 : False : False : NonNegativeReals

15 : 0 : 0.0 : 1 : False : False : NonNegativeReals

16 : 0 : 0.0 : 1 : False : False : NonNegativeReals

17 : 0 : 0.0 : 1 : False : False : NonNegativeReals

18 : 0 : 0.0 : 1 : False : False : NonNegativeReals

19 : 0 : 0.0 : 1 : False : False : NonNegativeReals

20 : 0 : 0.0 : 1 : False : False : NonNegativeReals

21 : 0 : 0.0 : 1 : False : False : NonNegativeReals

22 : 0 : 0.0 : 1 : False : False : NonNegativeReals

23 : 0 : 0.0 : 1 : False : False : NonNegativeReals

24 : 0 : 0.0 : 1 : False : False : NonNegativeReals

6 Declarations: HORIZON c d E sqrteta E0

We see the initialize keyword is used to set the parameter value. When mutable=True, Pyomo builds the model such that we can easily update the parameter and resolved. Later in the notebook, we will see how this is helpful.

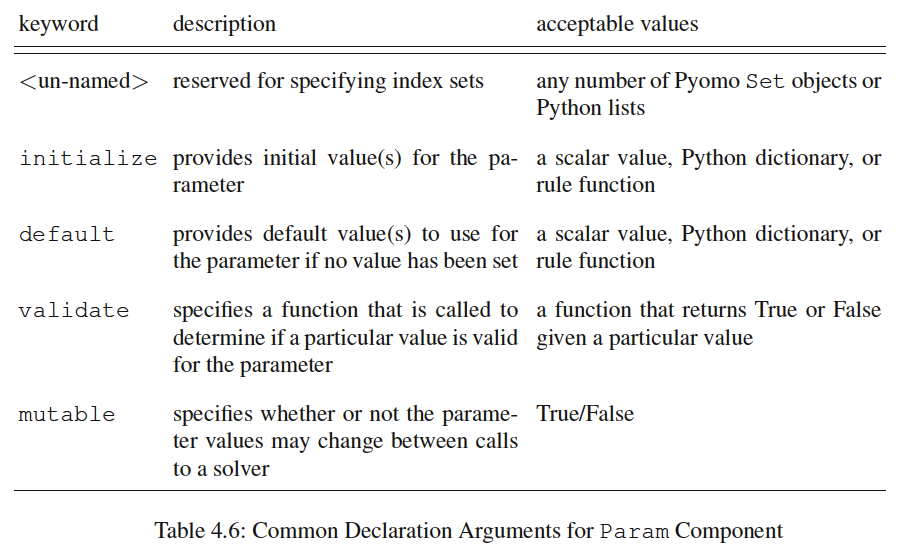

Below is a table (Hart et al., 2017) of options for Param:

Let's dig in more to the initialize syntax. First, let's convert the price data from pandas into a numpy array:

my_np_array = ca_data["price"].to_numpy()

# get the length

print("len(my_np_array) =",len(my_np_array))

len(my_np_array) = 8760

Recall, our dataset constains an entire year (which has 8760 hours). To access the first 24 hours, we use the following slice:

my_np_array[0:24]

array([36.757, 34.924, 33.389, 32.035, 33.694, 36.88 , 38.662, 38.975,

35.08 , 29.979, 27.546, 25.944, 24.587, 23.788, 25.236, 30.145,

44.622, 50.957, 59.345, 52.564, 52.819, 48.816, 46.685, 38.575])

len(my_np_array[0:24])

24

Initializing parameters in Pyomo can be precarious. The most fool proof strategy is to prepare a dictionary where the keys match the elements of the sets that index the parameter of interest. In our example, m.HORIZON contains 1, ..., 24, so we need a dictionary with the keys 1, ..., 24.

ca_data["price"][0:24].to_dict()

{0: 36.757,

1: 34.924,

2: 33.389,

3: 32.035,

4: 33.694,

5: 36.88,

6: 38.662,

7: 38.975,

8: 35.08,

9: 29.979,

10: 27.546,

11: 25.944,

12: 24.587,

13: 23.788,

14: 25.236,

15: 30.145,

16: 44.622,

17: 50.957,

18: 59.345,

19: 52.564,

20: 52.819,

21: 48.816,

22: 46.685,

23: 38.575}

That was easy. But what if we wanted to build the optimization model using the second day of data? Let's give it a try:

ca_data["price"][24:48].to_dict()

{24: 37.239,

25: 34.766,

26: 34.645,

27: 33.21,

28: 35.524,

29: 44.143,

30: 39.231,

31: 41.251,

32: 36.406,

33: 31.194,

34: 29.695,

35: 27.034,

36: 26.009,

37: 24.829,

38: 26.168,

39: 29.921,

40: 44.137,

41: 51.751,

42: 51.652,

43: 46.675,

44: 45.274,

45: 44.053,

46: 46.779,

47: 37.307}

# m.price = pyo.Param(m.HORIZON, initialize = ca_data["price"][24:48].to_dict(), domain=pyo.Reals)

You should get the following error:

ERROR: Constructing component 'price' from data=None failed: KeyError: "Index

'25' is not valid for indexed component 'price'"Why did this happen? Our dictionary started with key 25 but we tried to create a Param indexed over 1 through 24.

Let's say we want to build the optimization model starting for an arbitrary day. We need to extract the correct data from the pandas DataFrame and convert it to a dictionary with the correct keys. The function below does this using a simple, easy to follow approach. There is more compact "Pythonic" syntax to do this, but we will skip it for this getting started tutorial.

def prepare_price_data(day):

''' Prepare dictionary of price data

Arugments:

day: int, day to start. day = 0 is the first day

Returns:

data_dict: dictionary of price data with keys 1 to 24

Notes:

This function assumes the pandas DataFrame ca_data is in scope.

'''

# Create empty dictionary

data_dict = {}

# Extract data as numpy array

data_np_array = ca_data["price"][(day)*24:24*(day+1)].to_numpy()

# Loop over elements of numpy array

for i in range(0,24):

# Add element to data_dict

data_dict[i + 1] = data_np_array[i]

return data_dict

# Create input data for day 1 (i.e., January 2, 2015)

my_data_dict = prepare_price_data(1)

print(my_data_dict)

{1: 37.239, 2: 34.766, 3: 34.645, 4: 33.21, 5: 35.524, 6: 44.143, 7: 39.231, 8: 41.251, 9: 36.406, 10: 31.194, 11: 29.695, 12: 27.034, 13: 26.009, 14: 24.829, 15: 26.168, 16: 29.921, 17: 44.137, 18: 51.751, 19: 51.652, 20: 46.675, 21: 45.274, 22: 44.053, 23: 46.779, 24: 37.307}

# YOUR SOLUTION HERE

array([37.239, 34.766, 34.645, 33.21 , 35.524, 44.143, 39.231, 41.251,

36.406, 31.194, 29.695, 27.034, 26.009, 24.829, 26.168, 29.921,

44.137, 51.751, 51.652, 46.675, 45.274, 44.053, 46.779, 37.307])

Now we are ready to define the price data parameter:

m.price = pyo.Param(m.HORIZON, initialize = my_data_dict, domain=pyo.Reals, mutable=True)

Next, we will declare the objective function in Pyomo. Below are two equally valid syntax optimizations.

# Approach 1: Define a function and use *rule=*

def objfun(model):

return sum((-model.c[t] + model.d[t]) * model.price[t] for t in model.HORIZON)

m.OBJ = pyo.Objective(rule = objfun, sense = pyo.maximize)

# Approach 2: Use *expr=*

# m.OBJ = pyo.Objective(expr = sum((-m.c[t] + m.d[t]) * m.price[t] for t in model.HORIZON),

# sense = pyo.maximize)

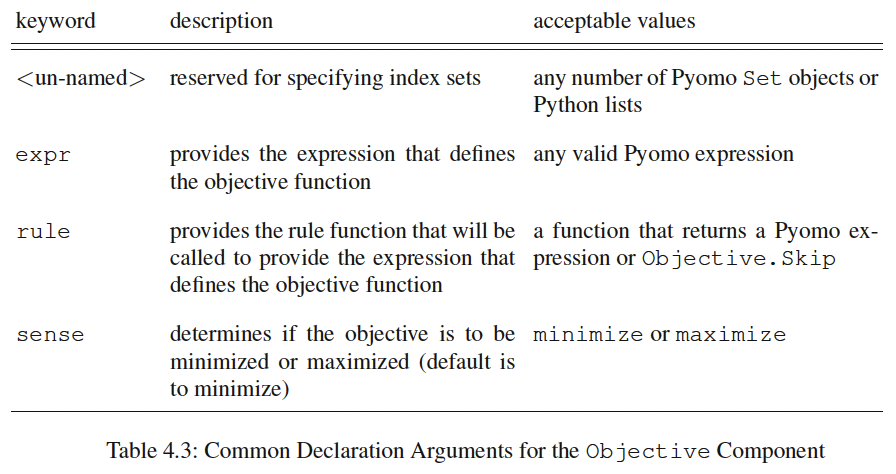

The following table (Hart et al., 2017) summarizes the keyword arguments for Objective:

Now let's add the last model component: the constraints.

# Define Energy Balance constraints. [MWh] = [MW]*[1 hr]

# Note: this model assumes 1-hour timestep in price data and control actions.

def EnergyBalance(model,t):

# First timestep

if t == 1 :

return model.E[t] == model.E0 + model.c[t]*model.sqrteta-model.d[t]/model.sqrteta

# Subsequent timesteps

else :

return model.E[t] == model.E[t-1]+model.c[t]*model.sqrteta-model.d[t]/model.sqrteta

m.EnergyBalance_Con = pyo.Constraint(m.HORIZON, rule = EnergyBalance)

# Enforce the amount of energy is the storage at the final time must equal

# the initial time.

# [MWh] = [MWh]

m.PeriodicBoundaryCondition = pyo.Constraint(expr=m.E0 == m.E[m.N])

Notice the above model includes detailed comments with the units for the left-hand side and right-hand side of each equation. This is strongly recommend; it is easy for units mistakes to go undetected in a complicated Pyomo model. Alternately, you can also use the units feature in Pyomo.

We see in this example a big advantage of the rule= approach for defininng a constraint. Inside the function EnergyBalance we incorporate a logical statement for how to handle the first timestep (which uses parameter E0).

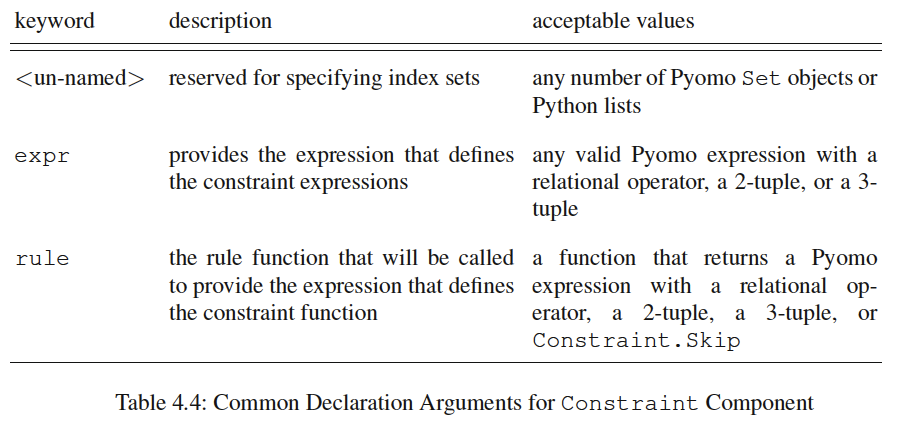

Below is a table of keyword arguments for Constraint:

Here is the optimization model, reproduced from above for convenience:

$$ \begin{align*} \max_{\mathbf{E},\mathbf{d},\mathbf{c}} \quad & \psi := \sum_{t \in \mathcal{T}'} \pi_{t} \Delta t (d_{t} - c_{t}) \\ \mathrm{s.t.} \quad & E_{t} = E_{t-1} + \Delta t \left( c_{t} \sqrt{\eta} - \frac{d_{t}}{\sqrt{\eta}} \right), ~~ \forall ~ t \in \mathcal{T}' \\ & E_{0} = E_{N} \\ & 0 \leq c_{t} \leq c_{max}, ~~\forall ~ t \in \mathcal{T}' \\ & 0 \leq d_{t} \leq d_{max}, ~~\forall ~ t \in \mathcal{T}' \\ & 0 \leq E_{t} \leq E_{max}, ~~\forall ~ t \in \mathcal{T}' \end{align*} $$Now let's see if our Pyomo model matches the optimization formulation. We will use the pprint() command (pretty print) to inspect the full model.

m.pprint()

1 Set Declarations

HORIZON : Size=1, Index=None, Ordered=Insertion

Key : Dimen : Domain : Size : Members

None : 1 : Any : 24 : {1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24}

3 Param Declarations

E0 : Size=1, Index=None, Domain=Any, Default=None, Mutable=True

Key : Value

None : 2.0

price : Size=24, Index=HORIZON, Domain=Reals, Default=None, Mutable=True

Key : Value

1 : 37.239

2 : 34.766

3 : 34.645

4 : 33.21

5 : 35.524

6 : 44.143

7 : 39.231

8 : 41.251

9 : 36.406

10 : 31.194

11 : 29.695

12 : 27.034

13 : 26.009

14 : 24.829

15 : 26.168

16 : 29.921

17 : 44.137

18 : 51.751

19 : 51.652

20 : 46.675

21 : 45.274

22 : 44.053

23 : 46.779

24 : 37.307

sqrteta : Size=1, Index=None, Domain=Any, Default=None, Mutable=False

Key : Value

None : 0.938083151964686

3 Var Declarations

E : Size=24, Index=HORIZON

Key : Lower : Value : Upper : Fixed : Stale : Domain

1 : 0 : 0.0 : 4 : False : False : NonNegativeReals

2 : 0 : 0.0 : 4 : False : False : NonNegativeReals

3 : 0 : 0.0 : 4 : False : False : NonNegativeReals

4 : 0 : 0.0 : 4 : False : False : NonNegativeReals

5 : 0 : 0.0 : 4 : False : False : NonNegativeReals

6 : 0 : 0.0 : 4 : False : False : NonNegativeReals

7 : 0 : 0.0 : 4 : False : False : NonNegativeReals

8 : 0 : 0.0 : 4 : False : False : NonNegativeReals

9 : 0 : 0.0 : 4 : False : False : NonNegativeReals

10 : 0 : 0.0 : 4 : False : False : NonNegativeReals

11 : 0 : 0.0 : 4 : False : False : NonNegativeReals

12 : 0 : 0.0 : 4 : False : False : NonNegativeReals

13 : 0 : 0.0 : 4 : False : False : NonNegativeReals

14 : 0 : 0.0 : 4 : False : False : NonNegativeReals

15 : 0 : 0.0 : 4 : False : False : NonNegativeReals

16 : 0 : 0.0 : 4 : False : False : NonNegativeReals

17 : 0 : 0.0 : 4 : False : False : NonNegativeReals

18 : 0 : 0.0 : 4 : False : False : NonNegativeReals

19 : 0 : 0.0 : 4 : False : False : NonNegativeReals

20 : 0 : 0.0 : 4 : False : False : NonNegativeReals

21 : 0 : 0.0 : 4 : False : False : NonNegativeReals

22 : 0 : 0.0 : 4 : False : False : NonNegativeReals

23 : 0 : 0.0 : 4 : False : False : NonNegativeReals

24 : 0 : 0.0 : 4 : False : False : NonNegativeReals

c : Size=24, Index=HORIZON

Key : Lower : Value : Upper : Fixed : Stale : Domain

1 : 0 : 0.0 : 1 : False : False : NonNegativeReals

2 : 0 : 0.0 : 1 : False : False : NonNegativeReals

3 : 0 : 0.0 : 1 : False : False : NonNegativeReals

4 : 0 : 0.0 : 1 : False : False : NonNegativeReals

5 : 0 : 0.0 : 1 : False : False : NonNegativeReals

6 : 0 : 0.0 : 1 : False : False : NonNegativeReals

7 : 0 : 0.0 : 1 : False : False : NonNegativeReals

8 : 0 : 0.0 : 1 : False : False : NonNegativeReals

9 : 0 : 0.0 : 1 : False : False : NonNegativeReals

10 : 0 : 0.0 : 1 : False : False : NonNegativeReals

11 : 0 : 0.0 : 1 : False : False : NonNegativeReals

12 : 0 : 0.0 : 1 : False : False : NonNegativeReals

13 : 0 : 0.0 : 1 : False : False : NonNegativeReals

14 : 0 : 0.0 : 1 : False : False : NonNegativeReals

15 : 0 : 0.0 : 1 : False : False : NonNegativeReals

16 : 0 : 0.0 : 1 : False : False : NonNegativeReals

17 : 0 : 0.0 : 1 : False : False : NonNegativeReals

18 : 0 : 0.0 : 1 : False : False : NonNegativeReals

19 : 0 : 0.0 : 1 : False : False : NonNegativeReals

20 : 0 : 0.0 : 1 : False : False : NonNegativeReals

21 : 0 : 0.0 : 1 : False : False : NonNegativeReals

22 : 0 : 0.0 : 1 : False : False : NonNegativeReals

23 : 0 : 0.0 : 1 : False : False : NonNegativeReals

24 : 0 : 0.0 : 1 : False : False : NonNegativeReals

d : Size=24, Index=HORIZON

Key : Lower : Value : Upper : Fixed : Stale : Domain

1 : 0 : 0.0 : 1 : False : False : NonNegativeReals

2 : 0 : 0.0 : 1 : False : False : NonNegativeReals

3 : 0 : 0.0 : 1 : False : False : NonNegativeReals

4 : 0 : 0.0 : 1 : False : False : NonNegativeReals

5 : 0 : 0.0 : 1 : False : False : NonNegativeReals

6 : 0 : 0.0 : 1 : False : False : NonNegativeReals

7 : 0 : 0.0 : 1 : False : False : NonNegativeReals

8 : 0 : 0.0 : 1 : False : False : NonNegativeReals

9 : 0 : 0.0 : 1 : False : False : NonNegativeReals

10 : 0 : 0.0 : 1 : False : False : NonNegativeReals

11 : 0 : 0.0 : 1 : False : False : NonNegativeReals

12 : 0 : 0.0 : 1 : False : False : NonNegativeReals

13 : 0 : 0.0 : 1 : False : False : NonNegativeReals

14 : 0 : 0.0 : 1 : False : False : NonNegativeReals

15 : 0 : 0.0 : 1 : False : False : NonNegativeReals

16 : 0 : 0.0 : 1 : False : False : NonNegativeReals

17 : 0 : 0.0 : 1 : False : False : NonNegativeReals

18 : 0 : 0.0 : 1 : False : False : NonNegativeReals

19 : 0 : 0.0 : 1 : False : False : NonNegativeReals

20 : 0 : 0.0 : 1 : False : False : NonNegativeReals

21 : 0 : 0.0 : 1 : False : False : NonNegativeReals

22 : 0 : 0.0 : 1 : False : False : NonNegativeReals

23 : 0 : 0.0 : 1 : False : False : NonNegativeReals

24 : 0 : 0.0 : 1 : False : False : NonNegativeReals

1 Objective Declarations

OBJ : Size=1, Index=None, Active=True

Key : Active : Sense : Expression

None : True : maximize : (- c[1] + d[1])*price[1] + (- c[2] + d[2])*price[2] + (- c[3] + d[3])*price[3] + (- c[4] + d[4])*price[4] + (- c[5] + d[5])*price[5] + (- c[6] + d[6])*price[6] + (- c[7] + d[7])*price[7] + (- c[8] + d[8])*price[8] + (- c[9] + d[9])*price[9] + (- c[10] + d[10])*price[10] + (- c[11] + d[11])*price[11] + (- c[12] + d[12])*price[12] + (- c[13] + d[13])*price[13] + (- c[14] + d[14])*price[14] + (- c[15] + d[15])*price[15] + (- c[16] + d[16])*price[16] + (- c[17] + d[17])*price[17] + (- c[18] + d[18])*price[18] + (- c[19] + d[19])*price[19] + (- c[20] + d[20])*price[20] + (- c[21] + d[21])*price[21] + (- c[22] + d[22])*price[22] + (- c[23] + d[23])*price[23] + (- c[24] + d[24])*price[24]

2 Constraint Declarations

EnergyBalance_Con : Size=24, Index=HORIZON, Active=True

Key : Lower : Body : Upper : Active

1 : 0.0 : E[1] - (E0 + 0.938083151964686*c[1] - 1.0660035817780522*d[1]) : 0.0 : True

2 : 0.0 : E[2] - (E[1] + 0.938083151964686*c[2] - 1.0660035817780522*d[2]) : 0.0 : True

3 : 0.0 : E[3] - (E[2] + 0.938083151964686*c[3] - 1.0660035817780522*d[3]) : 0.0 : True

4 : 0.0 : E[4] - (E[3] + 0.938083151964686*c[4] - 1.0660035817780522*d[4]) : 0.0 : True

5 : 0.0 : E[5] - (E[4] + 0.938083151964686*c[5] - 1.0660035817780522*d[5]) : 0.0 : True

6 : 0.0 : E[6] - (E[5] + 0.938083151964686*c[6] - 1.0660035817780522*d[6]) : 0.0 : True

7 : 0.0 : E[7] - (E[6] + 0.938083151964686*c[7] - 1.0660035817780522*d[7]) : 0.0 : True

8 : 0.0 : E[8] - (E[7] + 0.938083151964686*c[8] - 1.0660035817780522*d[8]) : 0.0 : True

9 : 0.0 : E[9] - (E[8] + 0.938083151964686*c[9] - 1.0660035817780522*d[9]) : 0.0 : True

10 : 0.0 : E[10] - (E[9] + 0.938083151964686*c[10] - 1.0660035817780522*d[10]) : 0.0 : True

11 : 0.0 : E[11] - (E[10] + 0.938083151964686*c[11] - 1.0660035817780522*d[11]) : 0.0 : True

12 : 0.0 : E[12] - (E[11] + 0.938083151964686*c[12] - 1.0660035817780522*d[12]) : 0.0 : True

13 : 0.0 : E[13] - (E[12] + 0.938083151964686*c[13] - 1.0660035817780522*d[13]) : 0.0 : True

14 : 0.0 : E[14] - (E[13] + 0.938083151964686*c[14] - 1.0660035817780522*d[14]) : 0.0 : True

15 : 0.0 : E[15] - (E[14] + 0.938083151964686*c[15] - 1.0660035817780522*d[15]) : 0.0 : True

16 : 0.0 : E[16] - (E[15] + 0.938083151964686*c[16] - 1.0660035817780522*d[16]) : 0.0 : True

17 : 0.0 : E[17] - (E[16] + 0.938083151964686*c[17] - 1.0660035817780522*d[17]) : 0.0 : True

18 : 0.0 : E[18] - (E[17] + 0.938083151964686*c[18] - 1.0660035817780522*d[18]) : 0.0 : True

19 : 0.0 : E[19] - (E[18] + 0.938083151964686*c[19] - 1.0660035817780522*d[19]) : 0.0 : True

20 : 0.0 : E[20] - (E[19] + 0.938083151964686*c[20] - 1.0660035817780522*d[20]) : 0.0 : True

21 : 0.0 : E[21] - (E[20] + 0.938083151964686*c[21] - 1.0660035817780522*d[21]) : 0.0 : True

22 : 0.0 : E[22] - (E[21] + 0.938083151964686*c[22] - 1.0660035817780522*d[22]) : 0.0 : True

23 : 0.0 : E[23] - (E[22] + 0.938083151964686*c[23] - 1.0660035817780522*d[23]) : 0.0 : True

24 : 0.0 : E[24] - (E[23] + 0.938083151964686*c[24] - 1.0660035817780522*d[24]) : 0.0 : True

PeriodicBoundaryCondition : Size=1, Index=None, Active=True

Key : Lower : Body : Upper : Active

None : E0 : E[24] : E0 : True

10 Declarations: HORIZON c d E sqrteta E0 price OBJ EnergyBalance_Con PeriodicBoundaryCondition

To emphasize the tutorial nature of this example, we build the model on piece at a time above. An often preferred approach is to define a Python function that builds the model, such as the one below.

# define a function to build model

def build_model(price,e0 = 0):

'''

Create optimization model for MPC

Arguments (inputs):

price: NumPy array with energy price timeseries

e0: initial value for energy storage level

Returns (outputs):

my_model: Pyomo optimization model

'''

# Create a concrete Pyomo model. We'll learn more about this in a few weeks

my_model = pyo.ConcreteModel()

## Define Sets

# Number of timesteps in planning horizon

my_model.HORIZON = pyo.Set(initialize = range(len(price)))

## Define Parameters

# Square root of round trip efficiency

my_model.sqrteta = pyo.Param(initialize = sqrt(0.88))

# Energy in battery at t=0

my_model.E0 = pyo.Param(initialize = e0, mutable=True)

## Define variables

# Charging rate [MW]

my_model.c = pyo.Var(my_model.HORIZON, initialize = 0.0, bounds=(0, 1))

# Discharging rate [MW]

my_model.d = pyo.Var(my_model.HORIZON, initialize = 0.0, bounds=(0, 1))

# Energy (state-of-charge) [MWh]

my_model.E = pyo.Var(my_model.HORIZON, initialize = 0.0, bounds=(0, 4))

## Define constraints

# Define Energy Balance constraints. [MWh] = [MW]*[1 hr]

# Note: this model assumes 1-hour timestep in price data and control actions.

def EnergyBalance(model,t):

# First timestep

if t == 0 :

return model.E[t] == model.E0 + model.c[t]*model.sqrteta-model.d[t]/model.sqrteta

# Subsequent timesteps

else :

return model.E[t] == model.E[t-1]+model.c[t]*model.sqrteta-model.d[t]/model.sqrteta

my_model.EnergyBalance_Con = pyo.Constraint(my_model.HORIZON, rule = EnergyBalance)

# Enforce the amount of energy is the storage at the final time must equal

# the initial time.

# [MWh] = [MWh]

my_model.PeriodicBoundaryCondition = pyo.Constraint(expr=my_model.E0 == my_model.E[len(price)-1])

## Define the objective function (profit)

# Receding horizon

def objfun(model):

return sum((-model.c[t] + model.d[t]) * price[t] for t in model.HORIZON)

my_model.OBJ = Objective(rule = objfun, sense = maximize)

return my_model

Now that our Pyomo model is complete, we can numerically solve the model!

SolverFactory and Solver Options¶Algebraic Modeling Languages, including Pyomo, allow us to define optimization problems is a general, solver agnostic way. This means we can quickly swap between solvers.

We will start by using Ipopt. First, we will create an instance of the SolverFactory:

# Specify the solver

solver = pyo.SolverFactory('ipopt')

Next we can specify options for ipopt such as setting the maximum number of iterations to 50:

solver.options['max_iter'] = 50

Above solver is a SolverFactory objection which includes the dictionary options used to set solver specific options.

Finally, we are ready to solve our model!

results = solver.solve(m, tee=True)

Ipopt 3.13.2: max_iter=50

******************************************************************************

This program contains Ipopt, a library for large-scale nonlinear optimization.

Ipopt is released as open source code under the Eclipse Public License (EPL).

For more information visit http://projects.coin-or.org/Ipopt

******************************************************************************

This is Ipopt version 3.13.2, running with linear solver ma27.

Number of nonzeros in equality constraint Jacobian...: 96

Number of nonzeros in inequality constraint Jacobian.: 0

Number of nonzeros in Lagrangian Hessian.............: 0

Total number of variables............................: 72

variables with only lower bounds: 0

variables with lower and upper bounds: 72

variables with only upper bounds: 0

Total number of equality constraints.................: 25

Total number of inequality constraints...............: 0

inequality constraints with only lower bounds: 0

inequality constraints with lower and upper bounds: 0

inequality constraints with only upper bounds: 0

iter objective inf_pr inf_du lg(mu) ||d|| lg(rg) alpha_du alpha_pr ls

0 4.9960036e-16 1.99e+00 9.90e+00 -1.0 0.00e+00 - 0.00e+00 0.00e+00 0

1 1.6802497e-01 1.96e+00 9.85e+00 -1.0 1.99e+00 - 5.21e-03 1.44e-02f 1

2 2.1332988e+00 1.75e+00 9.89e+00 -1.0 1.96e+00 - 1.53e-02 1.09e-01f 1

3 2.8652446e+00 1.35e+00 8.39e+00 -1.0 2.08e+00 - 1.09e-01 2.30e-01f 1

4 -4.0482581e+00 1.01e+00 7.83e+00 -1.0 1.86e+00 - 6.95e-02 2.48e-01f 1

5 -1.9676532e+01 8.93e-01 8.09e+00 -1.0 7.32e+00 - 6.32e-02 1.17e-01f 1

6 -3.4249188e+01 7.76e-01 7.89e+00 -1.0 6.21e+00 - 7.33e-02 1.32e-01f 1

7 -4.6657256e+01 6.62e-01 6.69e+00 -1.0 4.81e+00 - 1.52e-01 1.47e-01f 1

8 -5.7915679e+01 5.23e-01 5.29e+00 -1.0 3.16e+00 - 2.06e-01 2.09e-01f 1

9 -6.3119259e+01 3.85e-01 3.92e+00 -1.0 1.34e+00 - 2.30e-01 2.65e-01f 1

iter objective inf_pr inf_du lg(mu) ||d|| lg(rg) alpha_du alpha_pr ls

10 -6.3706910e+01 3.12e-02 6.94e+00 -1.0 1.08e+00 - 2.85e-01 9.19e-01f 1

11 -6.5994667e+01 7.15e-03 3.17e+00 -1.0 6.93e-01 - 4.40e-01 7.71e-01f 1

12 -6.6628205e+01 3.78e-03 7.49e-01 -1.0 9.35e-01 - 1.00e+00 4.72e-01f 1

13 -6.9888933e+01 5.35e-04 1.10e-01 -1.7 2.22e-01 - 8.88e-01 8.58e-01f 1

14 -7.1043057e+01 8.75e-05 1.55e-02 -2.5 2.18e-01 - 7.83e-01 8.36e-01f 1

15 -7.1364922e+01 1.18e-05 3.85e-02 -3.8 2.82e-01 - 6.56e-01 8.65e-01f 1

16 -7.1428935e+01 4.44e-16 7.22e-03 -3.8 5.71e-02 - 8.66e-01 1.00e+00f 1

17 -7.1430287e+01 4.44e-16 7.11e-15 -3.8 8.19e-03 - 1.00e+00 1.00e+00f 1

18 -7.1437864e+01 4.44e-16 6.15e-15 -5.7 1.65e-03 - 1.00e+00 1.00e+00f 1

19 -7.1437961e+01 8.88e-16 8.30e-15 -8.6 2.85e-05 - 1.00e+00 1.00e+00f 1

Number of Iterations....: 19

(scaled) (unscaled)

Objective...............: -7.1437960657726151e+01 -7.1437960657726151e+01

Dual infeasibility......: 8.2967961385731204e-15 8.2967961385731204e-15

Constraint violation....: 8.8817841970012523e-16 8.8817841970012523e-16

Complementarity.........: 3.2570997913605615e-09 3.2570997913605615e-09

Overall NLP error.......: 3.2570997913605615e-09 3.2570997913605615e-09

Number of objective function evaluations = 20

Number of objective gradient evaluations = 20

Number of equality constraint evaluations = 20

Number of inequality constraint evaluations = 0

Number of equality constraint Jacobian evaluations = 20

Number of inequality constraint Jacobian evaluations = 0

Number of Lagrangian Hessian evaluations = 19

Total CPU secs in IPOPT (w/o function evaluations) = 0.004

Total CPU secs in NLP function evaluations = 0.000

EXIT: Optimal Solution Found.

The keyword argument tee=True tells the solve to dispaly its output to the screen.

Your Ipopt output should include the following:

Number of nonzeros in equality constraint Jacobian...: 96

Number of nonzeros in inequality constraint Jacobian.: 0

Number of nonzeros in Lagrangian Hessian.............: 0

Total number of variables............................: 72

variables with only lower bounds: 0

variables with lower and upper bounds: 72

variables with only upper bounds: 0

Total number of equality constraints.................: 25

Total number of inequality constraints...............: 0

inequality constraints with only lower bounds: 0

inequality constraints with lower and upper bounds: 0

inequality constraints with only upper bounds: 0Let's see how easy it is to switch to another solver with Pyomo.

# YOUR SOLUTION HERE

GLPSOL: GLPK LP/MIP Solver, v4.65

Parameter(s) specified in the command line:

--write /var/folders/xy/24xvnyss36v3d8mw68tygxdw0000gp/T/tmpgl_k9y29.glpk.raw

--wglp /var/folders/xy/24xvnyss36v3d8mw68tygxdw0000gp/T/tmphvy697ij.glpk.glp

--cpxlp /var/folders/xy/24xvnyss36v3d8mw68tygxdw0000gp/T/tmpm8vhuqto.pyomo.lp

Reading problem data from '/var/folders/xy/24xvnyss36v3d8mw68tygxdw0000gp/T/tmpm8vhuqto.pyomo.lp'...

26 rows, 73 columns, 97 non-zeros

303 lines were read

Writing problem data to '/var/folders/xy/24xvnyss36v3d8mw68tygxdw0000gp/T/tmphvy697ij.glpk.glp'...

322 lines were written

GLPK Simplex Optimizer, v4.65

26 rows, 73 columns, 97 non-zeros

Preprocessing...

24 rows, 47 columns, 70 non-zeros

Scaling...

A: min|aij| = 9.381e-01 max|aij| = 1.066e+00 ratio = 1.136e+00

Problem data seem to be well scaled

Constructing initial basis...

Size of triangular part is 24

0: obj = -1.449764871e-01 inf = 3.062e+00 (2)

5: obj = -2.220151385e+01 inf = 0.000e+00 (0)

* 33: obj = 7.143795836e+01 inf = 0.000e+00 (0)

OPTIMAL LP SOLUTION FOUND

Time used: 0.0 secs

Memory used: 0.1 Mb (78205 bytes)

Writing basic solution to '/var/folders/xy/24xvnyss36v3d8mw68tygxdw0000gp/T/tmpgl_k9y29.glpk.raw'...

108 lines were written

Notice we used solver2, which is an instance of SolverFactory for the solver glpk. But we reused model m. This means the solver glpk used the solution from ipopt as its initial point.

We can inspect the entire model solution using pprint().

m.pprint()

1 Set Declarations

HORIZON : Size=1, Index=None, Ordered=Insertion

Key : Dimen : Domain : Size : Members

None : 1 : Any : 24 : {1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24}

3 Param Declarations

E0 : Size=1, Index=None, Domain=Any, Default=None, Mutable=True

Key : Value

None : 2.0

price : Size=24, Index=HORIZON, Domain=Reals, Default=None, Mutable=True

Key : Value

1 : 37.239

2 : 34.766

3 : 34.645

4 : 33.21

5 : 35.524

6 : 44.143

7 : 39.231

8 : 41.251

9 : 36.406

10 : 31.194

11 : 29.695

12 : 27.034

13 : 26.009

14 : 24.829

15 : 26.168

16 : 29.921

17 : 44.137

18 : 51.751

19 : 51.652

20 : 46.675

21 : 45.274

22 : 44.053

23 : 46.779

24 : 37.307

sqrteta : Size=1, Index=None, Domain=Any, Default=None, Mutable=False

Key : Value

None : 0.938083151964686

3 Var Declarations

E : Size=24, Index=HORIZON

Key : Lower : Value : Upper : Fixed : Stale : Domain

1 : 0 : 2.0 : 4 : False : False : NonNegativeReals

2 : 0 : 2.0 : 4 : False : False : NonNegativeReals

3 : 0 : 2.0 : 4 : False : False : NonNegativeReals

4 : 0 : 2.93808315196469 : 4 : False : False : NonNegativeReals

5 : 0 : 2.93808315196469 : 4 : False : False : NonNegativeReals

6 : 0 : 1.87207957018663 : 4 : False : False : NonNegativeReals

7 : 0 : 1.06600358177805 : 4 : False : False : NonNegativeReals

8 : 0 : 0.0 : 4 : False : False : NonNegativeReals

9 : 0 : 0.0 : 4 : False : False : NonNegativeReals

10 : 0 : 0.0 : 4 : False : False : NonNegativeReals

11 : 0 : 0.247667392141256 : 4 : False : False : NonNegativeReals

12 : 0 : 1.18575054410594 : 4 : False : False : NonNegativeReals

13 : 0 : 2.12383369607063 : 4 : False : False : NonNegativeReals

14 : 0 : 3.06191684803531 : 4 : False : False : NonNegativeReals

15 : 0 : 4.0 : 4 : False : False : NonNegativeReals

16 : 0 : 4.0 : 4 : False : False : NonNegativeReals

17 : 0 : 4.0 : 4 : False : False : NonNegativeReals

18 : 0 : 2.93399641822195 : 4 : False : False : NonNegativeReals

19 : 0 : 1.8679928364439 : 4 : False : False : NonNegativeReals

20 : 0 : 1.8679928364439 : 4 : False : False : NonNegativeReals

21 : 0 : 1.8679928364439 : 4 : False : False : NonNegativeReals

22 : 0 : 1.8679928364439 : 4 : False : False : NonNegativeReals

23 : 0 : 1.06191684803531 : 4 : False : False : NonNegativeReals

24 : 0 : 2.0 : 4 : False : False : NonNegativeReals

c : Size=24, Index=HORIZON

Key : Lower : Value : Upper : Fixed : Stale : Domain

1 : 0 : 0.0 : 1 : False : False : NonNegativeReals

2 : 0 : 0.0 : 1 : False : False : NonNegativeReals

3 : 0 : 0.0 : 1 : False : False : NonNegativeReals

4 : 0 : 1.0 : 1 : False : False : NonNegativeReals

5 : 0 : 0.0 : 1 : False : False : NonNegativeReals

6 : 0 : 0.0 : 1 : False : False : NonNegativeReals

7 : 0 : 0.0 : 1 : False : False : NonNegativeReals

8 : 0 : 0.0 : 1 : False : False : NonNegativeReals

9 : 0 : 0.0 : 1 : False : False : NonNegativeReals

10 : 0 : -0.0 : 1 : False : False : NonNegativeReals

11 : 0 : 0.264014327112209 : 1 : False : False : NonNegativeReals

12 : 0 : 1.0 : 1 : False : False : NonNegativeReals

13 : 0 : 1.0 : 1 : False : False : NonNegativeReals

14 : 0 : 1.0 : 1 : False : False : NonNegativeReals

15 : 0 : 1.0 : 1 : False : False : NonNegativeReals

16 : 0 : -0.0 : 1 : False : False : NonNegativeReals

17 : 0 : 0.0 : 1 : False : False : NonNegativeReals

18 : 0 : 0.0 : 1 : False : False : NonNegativeReals

19 : 0 : 0.0 : 1 : False : False : NonNegativeReals

20 : 0 : 0.0 : 1 : False : False : NonNegativeReals

21 : 0 : 0.0 : 1 : False : False : NonNegativeReals

22 : 0 : 0.0 : 1 : False : False : NonNegativeReals

23 : 0 : 0.0 : 1 : False : False : NonNegativeReals

24 : 0 : 1.0 : 1 : False : False : NonNegativeReals

d : Size=24, Index=HORIZON

Key : Lower : Value : Upper : Fixed : Stale : Domain

1 : 0 : 0.0 : 1 : False : False : NonNegativeReals

2 : 0 : 0.0 : 1 : False : False : NonNegativeReals

3 : 0 : 0.0 : 1 : False : False : NonNegativeReals

4 : 0 : 0.0 : 1 : False : False : NonNegativeReals

5 : 0 : 0.0 : 1 : False : False : NonNegativeReals

6 : 0 : 1.0 : 1 : False : False : NonNegativeReals

7 : 0 : 0.756166303929372 : 1 : False : False : NonNegativeReals

8 : 0 : 1.0 : 1 : False : False : NonNegativeReals

9 : 0 : 0.0 : 1 : False : False : NonNegativeReals

10 : 0 : 0.0 : 1 : False : False : NonNegativeReals

11 : 0 : 0.0 : 1 : False : False : NonNegativeReals

12 : 0 : 0.0 : 1 : False : False : NonNegativeReals

13 : 0 : 0.0 : 1 : False : False : NonNegativeReals

14 : 0 : 0.0 : 1 : False : False : NonNegativeReals

15 : 0 : 0.0 : 1 : False : False : NonNegativeReals

16 : 0 : 0.0 : 1 : False : False : NonNegativeReals

17 : 0 : 0.0 : 1 : False : False : NonNegativeReals

18 : 0 : 1.0 : 1 : False : False : NonNegativeReals

19 : 0 : 1.0 : 1 : False : False : NonNegativeReals

20 : 0 : 0.0 : 1 : False : False : NonNegativeReals

21 : 0 : 0.0 : 1 : False : False : NonNegativeReals

22 : 0 : 0.0 : 1 : False : False : NonNegativeReals

23 : 0 : 0.756166303929372 : 1 : False : False : NonNegativeReals

24 : 0 : 0.0 : 1 : False : False : NonNegativeReals

1 Objective Declarations

OBJ : Size=1, Index=None, Active=True

Key : Active : Sense : Expression

None : True : maximize : (- c[1] + d[1])*price[1] + (- c[2] + d[2])*price[2] + (- c[3] + d[3])*price[3] + (- c[4] + d[4])*price[4] + (- c[5] + d[5])*price[5] + (- c[6] + d[6])*price[6] + (- c[7] + d[7])*price[7] + (- c[8] + d[8])*price[8] + (- c[9] + d[9])*price[9] + (- c[10] + d[10])*price[10] + (- c[11] + d[11])*price[11] + (- c[12] + d[12])*price[12] + (- c[13] + d[13])*price[13] + (- c[14] + d[14])*price[14] + (- c[15] + d[15])*price[15] + (- c[16] + d[16])*price[16] + (- c[17] + d[17])*price[17] + (- c[18] + d[18])*price[18] + (- c[19] + d[19])*price[19] + (- c[20] + d[20])*price[20] + (- c[21] + d[21])*price[21] + (- c[22] + d[22])*price[22] + (- c[23] + d[23])*price[23] + (- c[24] + d[24])*price[24]

2 Constraint Declarations

EnergyBalance_Con : Size=24, Index=HORIZON, Active=True

Key : Lower : Body : Upper : Active

1 : 0.0 : E[1] - (E0 + 0.938083151964686*c[1] - 1.0660035817780522*d[1]) : 0.0 : True

2 : 0.0 : E[2] - (E[1] + 0.938083151964686*c[2] - 1.0660035817780522*d[2]) : 0.0 : True

3 : 0.0 : E[3] - (E[2] + 0.938083151964686*c[3] - 1.0660035817780522*d[3]) : 0.0 : True

4 : 0.0 : E[4] - (E[3] + 0.938083151964686*c[4] - 1.0660035817780522*d[4]) : 0.0 : True

5 : 0.0 : E[5] - (E[4] + 0.938083151964686*c[5] - 1.0660035817780522*d[5]) : 0.0 : True

6 : 0.0 : E[6] - (E[5] + 0.938083151964686*c[6] - 1.0660035817780522*d[6]) : 0.0 : True

7 : 0.0 : E[7] - (E[6] + 0.938083151964686*c[7] - 1.0660035817780522*d[7]) : 0.0 : True

8 : 0.0 : E[8] - (E[7] + 0.938083151964686*c[8] - 1.0660035817780522*d[8]) : 0.0 : True

9 : 0.0 : E[9] - (E[8] + 0.938083151964686*c[9] - 1.0660035817780522*d[9]) : 0.0 : True

10 : 0.0 : E[10] - (E[9] + 0.938083151964686*c[10] - 1.0660035817780522*d[10]) : 0.0 : True

11 : 0.0 : E[11] - (E[10] + 0.938083151964686*c[11] - 1.0660035817780522*d[11]) : 0.0 : True

12 : 0.0 : E[12] - (E[11] + 0.938083151964686*c[12] - 1.0660035817780522*d[12]) : 0.0 : True

13 : 0.0 : E[13] - (E[12] + 0.938083151964686*c[13] - 1.0660035817780522*d[13]) : 0.0 : True

14 : 0.0 : E[14] - (E[13] + 0.938083151964686*c[14] - 1.0660035817780522*d[14]) : 0.0 : True

15 : 0.0 : E[15] - (E[14] + 0.938083151964686*c[15] - 1.0660035817780522*d[15]) : 0.0 : True

16 : 0.0 : E[16] - (E[15] + 0.938083151964686*c[16] - 1.0660035817780522*d[16]) : 0.0 : True

17 : 0.0 : E[17] - (E[16] + 0.938083151964686*c[17] - 1.0660035817780522*d[17]) : 0.0 : True

18 : 0.0 : E[18] - (E[17] + 0.938083151964686*c[18] - 1.0660035817780522*d[18]) : 0.0 : True

19 : 0.0 : E[19] - (E[18] + 0.938083151964686*c[19] - 1.0660035817780522*d[19]) : 0.0 : True

20 : 0.0 : E[20] - (E[19] + 0.938083151964686*c[20] - 1.0660035817780522*d[20]) : 0.0 : True

21 : 0.0 : E[21] - (E[20] + 0.938083151964686*c[21] - 1.0660035817780522*d[21]) : 0.0 : True

22 : 0.0 : E[22] - (E[21] + 0.938083151964686*c[22] - 1.0660035817780522*d[22]) : 0.0 : True

23 : 0.0 : E[23] - (E[22] + 0.938083151964686*c[23] - 1.0660035817780522*d[23]) : 0.0 : True

24 : 0.0 : E[24] - (E[23] + 0.938083151964686*c[24] - 1.0660035817780522*d[24]) : 0.0 : True

PeriodicBoundaryCondition : Size=1, Index=None, Active=True

Key : Lower : Body : Upper : Active

None : E0 : E[24] : E0 : True

10 Declarations: HORIZON c d E sqrteta E0 price OBJ EnergyBalance_Con PeriodicBoundaryCondition

The solution is stored in the value column. This is helpful for debugging small models but tendious overwise.

A key advantage of Pyomo is that it is an Algebriac Modeling Language in Python. So let's use Python to analyze the solution! The code below extracts the values of the variables into three lists.

# Declare empty lists

c_control = []

d_control = []

E_control = []

t = []

# Loop over elements of HORIZON set.

for i in m.HORIZON:

t.append(pyo.value(i))

# Use value( ) function to extract the solution for each varliable and append to the results lists

c_control.append(pyo.value(m.c[i]))

# Adding negative sign to discharge for plotting

d_control.append(-pyo.value(m.d[i]))

E_control.append(pyo.value(m.E[i]))

print(c_control)

[0.0, 0.0, 0.0, 1.0, 0.0, 0.0, 0.0, 0.0, 0.0, -0.0, 0.264014327112209, 1.0, 1.0, 1.0, 1.0, -0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 1.0]

print(d_control)

[-0.0, -0.0, -0.0, -0.0, -0.0, -1.0, -0.756166303929372, -1.0, -0.0, -0.0, -0.0, -0.0, -0.0, -0.0, -0.0, -0.0, -0.0, -1.0, -1.0, -0.0, -0.0, -0.0, -0.756166303929372, -0.0]

print(E_control)

[2.0, 2.0, 2.0, 2.93808315196469, 2.93808315196469, 1.87207957018663, 1.06600358177805, 0.0, 0.0, 0.0, 0.247667392141256, 1.18575054410594, 2.12383369607063, 3.06191684803531, 4.0, 4.0, 4.0, 2.93399641822195, 1.8679928364439, 1.8679928364439, 1.8679928364439, 1.8679928364439, 1.06191684803531, 2.0]

# Plot the state of charge (E)

plt.figure()

# add E0

t_ = [0] + t

E_control_ = [pyo.value(m.E0)] + E_control

plt.plot(t,E_control,'b.-')

plt.xlabel('Time (hr)')

plt.ylabel('Energy in Storage (MWh)')

plt.xticks(range(0,25,3))

plt.grid(True)

plt.show()

# This should NOT be a stair plot as energy is the integral of power. The graph below is reasonable.

# Plot the charging and discharging rates

plt.figure()

# double up first data point to make the step plot

c_control_ = [c_control[0]] + c_control

d_control_ = [d_control[0]] + d_control

plt.step(t_,c_control_,'r.-',where='pre')

plt.step(t_,d_control_,'g.-',where='pre')

plt.xlabel('Time (hr)')

plt.ylabel('Power from Grid (MW)')

plt.xticks(range(0,25,3))

plt.grid(True)

plt.show()

Coming Soon! This will get updated sometime during the first month. We will revisit dual variables later in the semester after introducing some optimization theory concepts.

All tables are from Chapter 4 of Hart, W. E., Laird, C. D., Watson, J. P., Woodruff, D. L., Hackebeil, G. A., Nicholson, B. L., & Siirola, J. D. (2017). Pyomo-Optimization Modeling in Python (Vol. 67). Berlin: Springer. https://www.springer.com/gp/book/9783319588193